IRS Direct Deposit: Relief Payments in November 2025?

Generated Title: No November Stimulus? Separating Fact From Fiscal Fantasy

It's that time again. The digital rumor mill is churning, fueled by whispers of surprise stimulus checks landing in bank accounts this November. But before you start mentally allocating that windfall, let's inject some cold, hard data into the conversation. The reality is far less exciting.

The last broad federal stimulus payments hit accounts back in 2021. Since then, Congress hasn't exactly been racing to pass new relief measures. The IRS did send out some automatic payments in late 2024 and early 2025 to folks who hadn't claimed the Recovery Rebate Credit on their 2021 tax returns. Max payout? $1,400 per individual. The deadline to claim that credit, however, was April 15, 2025. Missed it? So did a lot of people. (The IRS doesn't publish the exact number of missed claims, oddly.)

Tariff Dividends: Trump's Truth Social Promise

Enter Donald Trump with a proposal that’s raising eyebrows—and, predictably, some hopes. He's floated the idea of "tariff dividends," funded by revenue from tariffs. A cool $2,000 per person (excluding, he clarifies, "high-income people!"). He took to Truth Social to defend tariffs, painting a rosy picture of a strong economy and a booming stock market. He even suggested using leftover funds to chip away at the national debt.

Now, here's where the data analyst in me gets twitchy. Tariff revenue is notoriously volatile. It's dependent on trade flows, global economic conditions, and, frankly, the whims of international relations. Basing a large-scale dividend program on such an unpredictable revenue stream seems… optimistic. Is it even feasible? Treasury Secretary Scott Bessent has hinted at income caps of $100,000 or less to qualify, but the specifics are still murky. Where is my IRS direct deposit relief payment? And what about the tariff dividend?

And this is the part of the report that I find genuinely puzzling. If the goal is debt reduction, wouldn't it make more sense to directly apply tariff revenue to the debt, rather than routing it through individual payments? The administrative overhead alone would eat into any potential savings. The CBO hasn't released an analysis of the proposal, but my back-of-the-envelope calculations suggest the transaction costs could be substantial.

Scam Season: Don't Fall for the Bait

Regardless, the lack of concrete details hasn't stopped the scammers. They're out in force, peddling fake stimulus payment messages via email, text, and social media. The IRS is actively warning people about these scams, reminding everyone that they never initiate contact through those channels. They start with an official letter or notice. Remember that.

Crystal Stranger, a tax director at Optic Tax, made a keen observation: The last stimulus checks were, for some, delivered as gift cards, which looked, well, a lot like scams. Makes it harder to distinguish between legitimate aid and outright fraud, doesn't it? James Creech, a tax advisor at Baker Tilly, puts it bluntly: "These scam artists are out of control." He focuses on theft losses due to relief check scams, and I can only imagine the stories he hears.

The recurring claims of $1,702 payments? Often linked to state-level programs or, more likely, just plain scams. It's a constant game of whack-a-mole. Michael Cohn, online editor in chief of Accounting Today, notes that these rumors proliferate during times of economic uncertainty. People are looking for a lifeline, and scammers are more than happy to throw them a fake one. Stimulus payment November 2025, IRS direct deposit relief payment & tariff dividend fact check

Is This Just Smoke and Mirrors?

The bottom line? No new federal stimulus checks are currently authorized. Trump's tariff dividend remains a proposal, not a policy. And the IRS is working overtime to combat a rising tide of stimulus-related scams. So, temper your expectations, people. And for God's sake, don't click on any suspicious links.

Related Articles

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

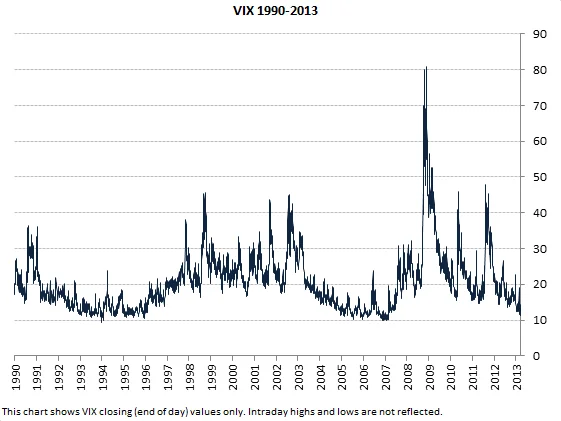

VIX Surge: Economic Data Disruption and... What Now?

Okay, so the market's officially lost its mind. SPY and QQQ both tanking over 1.5%? Give me a break....

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...