Dow Jones Tumbles: Tech Sell-Off and Rate Cut Uncertainty

Alright, let's get into it. Thursday wasn't pretty if you were watching the tickers. The Dow took a 797-point nosedive (1.65%, to be exact), the S&P 500 dropped 1.66%, and the Nasdaq got hammered, shedding 2.29%. The Russell 2000 also had a rough time, marking the worst day for all three major averages since October 10. Classic "risk-off" day, but the question is, why?

Decoding the Dip: AI and Shutdown Aftershocks

The headline grabber is the tech sell-off, particularly in AI-related stocks. Nvidia, Broadcom, Alphabet – the usual suspects – were taking it on the chin. The Nasdaq even dipped below its 50-day moving average (22,810.13, to be precise). If it closes below that level, it'll be the first time since April 30. Is this a genuine correction based on overinflated valuations, or just profit-taking after a monster run? I'm leaning towards the former. The multiples on some of these AI plays were getting cartoonish.

Then there's Disney. Shares tanked nearly 8% despite beating earnings estimates ($1.11 per share adjusted vs. $1.05 expected). Revenue, however, missed the mark ($22.46 billion vs. $22.75 billion expected). Mr. Market doesn’t like mixed signals.

And let’s not forget the macro picture. The government shutdown, which finally ended Wednesday evening, is still casting a shadow. The White House is saying it could shave up to 2 percentage points off fourth-quarter economic growth. But here's where I start to get skeptical. They also said that some economic data might never be released due to the shutdown. Convenient, isn’t it? (Hiding bad news under the rug is a classic DC move.) How much of this market wobble is a delayed reaction to the shutdown, and how much is just a convenient excuse? It's hard to say when the data itself is questionable.

On the flip side, we had some winners. Cisco jumped over 7% premarket after posting better-than-expected profit and revenue ($1 in adjusted EPS on $14.88 billion in revenue). They even raised their full-year outlook (adjusted earnings between $4.08 and $4.14 per share, revenue at $60.2 billion to $61 billion). Firefly Aerospace also saw its shares surge more than 20% after strong Q3 results.

Parsing the Positives: XRP, Space, and Prediction Markets

Speaking of winners, XRP is up roughly 4% on Thursday after Canary Capital launched its spot XRP ETF. Spot ETFs continue to dominate headlines after Bitcoin and Ether-based counterparts were greenlit last year.

TKO Group Holdings, the folks behind UFC, are partnering with Polymarket to bring real-time prediction markets into live combat sports. Ariel Emanuel, TKO's executive chair and CEO, is calling it a way to transform passive viewership into active participation. Seems like a smart way to juice engagement, but I’m not convinced it’ll move the needle much for the stock. (Gambling and combat sports already have a pretty tight relationship, if you hadn’t noticed.)

And what about Elon Musk's xAI raising $15 billion? Does that inject confidence into the AI sector, or does it highlight just how much capital is chasing too few truly viable AI companies? I'm honestly not sure.

I've looked at hundreds of these market reports, and what strikes me is how easily narratives are constructed after the fact. "Market down due to AI fears!" But what if the market was just due for a pullback, and AI was the easiest story to tell? That's the part of the game that feels the most like reading tea leaves.

Other notable moves: Dillard's up over 8% after solid quarterly results (revenue of $1.49 billion, comparable store sales up 3%). Sweetgreen's co-founder bought about $1 million worth of stock. Sealed Air jumped 19% on acquisition rumors. Cash App is planning to support stablecoins early next year. And the Health Care Select Sector SPDR Fund (XLV) is on a tear, up nearly 1% midday and pacing for its ninth positive session in a row.

Finally, Bitcoin took a dive, hitting $98,072.76 – its lowest level since May 8.

The probability of a Fed rate cut in December dropped from 62.9% to roughly 52%. Krishna Guha at Evercore ISI is saying that recent developments chip away at their confidence in a December cut, putting the odds at 55-60%.

Is This Just a Blip, or Something More?

Is this just a healthy correction, as Ron Albahary at Laird Norton Wealth Management suggests? Maybe. Is it a sign that the AI bubble is starting to deflate? Possibly. Is it a reflection of underlying economic weakness masked by delayed government data? Potentially. It's probably some combination of all three. The real question is, what do you do with this information? For me, it's a reminder to stay disciplined, stick to the plan, and not get caught up in the day-to-day noise.

Data Points Don't Always Tell the Whole Story

Previous Post:nbis stock: What's the deal?

Next Post:IRS Direct Deposit: Relief Payments in November 2025?

Related Articles

kathy ireland: Encouraging Reading and Finding Peace

Okay, folks, buckle up. Because what I'm about to tell you isn't just another celebrity-endorsed pro...

IRS Direct Deposit: Relief Payments in November 2025?

Generated Title: No November Stimulus? Separating Fact From Fiscal Fantasy It's that time again. The...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

Michael Burry Shuts Down Scion: What Happened and the Reactions

Michael Burry's Pulling the Plug? Good Riddance. So, Michael Burry's apparently shutting down his he...

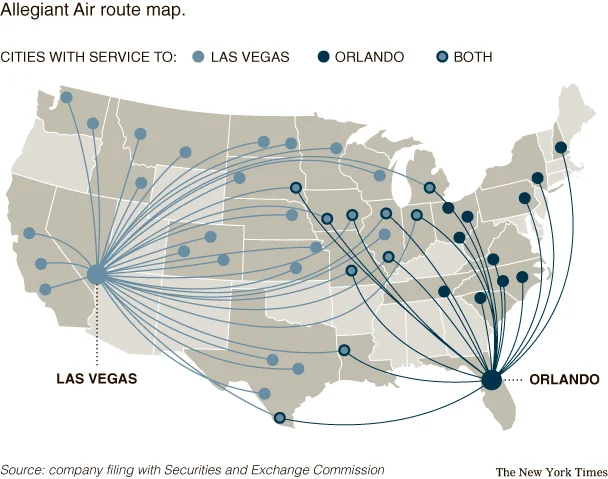

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...