VIX Surge: Economic Data Disruption and... What Now?

Okay, so the market's officially lost its mind. SPY and QQQ both tanking over 1.5%? Give me a break. Seems like the post-shutdown "everything's awesome" party lasted about as long as my last Tinder date.

Data? What Data?

The supposed reason for the meltdown? We're missing economic data. Like, the government forgot to release it? Hassett says the Labor Department might get September's jobs report out next week. Maybe. October's CPI and jobless claims? Vanished. Poof.

Leavitt's already blaming the Democrats for "permanently damaging the federal statistical system." Right, because that's believable. They expect us to swallow that nonsense, and honestly...

Is this some kind of new reality show? "The Real Housewives of Economic Policy?" Because it sure feels like it. Maybe they're just trying to distract us from something else. What are they hiding, and more importantly, is it gonna cost me more at the pump?

Fear is Back, Baby

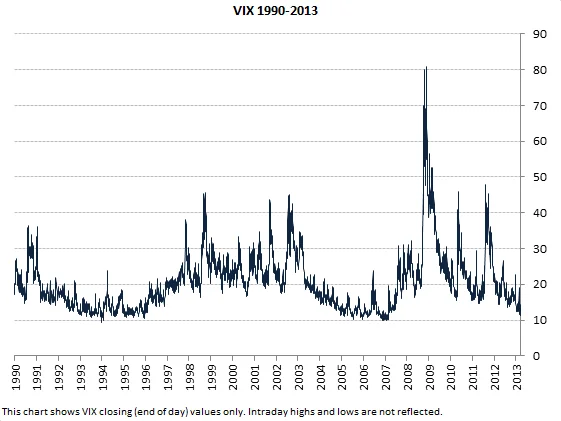

Volatility's back, with VIX jumping 15%. CNN's Fear and Greed Index is flashing "extreme fear." You know, the kind of fear you feel when you check your bank account after a weekend in Vegas.

And speaking of bad decisions, the Fed is waffling. Higher interest rates to fight inflation, but then they gotta worry about maximum employment. It's like trying to juggle chainsaws while riding a unicycle.

Timiraos from the WSJ points out that four Fed presidents aren't exactly screaming for a December rate cut. No kidding. The odds of a cut are dropping faster than my IQ points after watching reality TV. 51.9% now, compared to 69.6% a week ago. That's basically a coin flip. Heads, we're screwed. Tails, we're slightly less screwed.

Here's what I don't get: if the Fed knows inflation is still a problem (CPI at 3%, still above their target), why were people even expecting a rate cut in the first place? Are investors this delusional, or are they just praying for a miracle?

And while we're at it, let's talk about these job cuts. Challenger, Gray & Christmas (whoever the hell they are) reported 153,074 job cuts in October. That's the highest since 2003. So, the Fed's caught between a rock and a hard place: fight inflation and risk more job losses, or cut rates and let inflation run wild. Ether way, it aint good.

Meanwhile, in Other News...

Oh, and just to add insult to injury, I tried to check out TelevisaUnivision, but apparently, it's "not available in my region." Seriously? I live in America! What, am I suddenly living in North Korea?

Then again, maybe I'm the crazy one here. Maybe I should just ignore the market, binge-watch some reality TV, and pretend everything's fine. But then again, that's what got us into this mess in the first place.

Speaking of distractions, William Levy's got a new action-romance movie coming out on ViX. "Bajo un volcán." A volcano movie? Perfect timing. Because that's exactly how my portfolio feels right now: about to erupt. ViX Premieres Bajo Un Volcán, William Levy’s First Feature Film Shot in Spain

So, What's the Real Story?

The market's a rigged game, the data's a joke, and the Fed's clueless. Time to stock up on popcorn and watch the whole thing burn.

Related Articles

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...

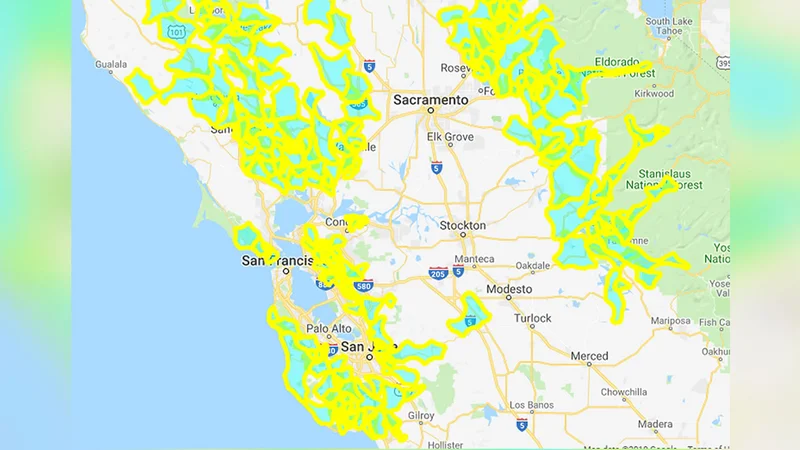

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

The ASML Stock Frenzy: Why Everyone's Suddenly Obsessed and What They're Not Telling You

Let's get one thing straight. Every time I see a headline about ASML’s stock climbing another few pe...

American Battery's Breakthrough: Why It's Surging and What It Means for the Future of Energy

The Quiet Roar of the Energy Transition Just Became Deafening When I saw the news flash across my sc...

The Surprising Tech of Orvis: Why Their Fly Rods, Jackets, and Dog Beds Endure

When I first saw the headlines about Orvis closing 31 of its stores, I didn't feel a pang of nostalg...