Michael Burry Shuts Down Scion: What Happened and the Reactions

Michael Burry's Pulling the Plug? Good Riddance.

So, Michael Burry's apparently shutting down his hedge fund, Scion Asset Management. Again. Claims his "estimation of value in securities is not now, and has not been for some time, in sync with the markets." Oh, boo-hoo.

Let’s be real: the guy made a fortune betting against the housing market in '08. Big deal. Anyone with half a brain could see that train wreck coming. And now he's acting like some kind of financial Nostradamus because he made a few bucks? Give me a break.

The "Big Short" Myth

The whole "Big Short" narrative turned Burry into some kind of anti-hero, a lone wolf fighting against Wall Street corruption. Please. He was just another guy playing the game, and he happened to get lucky. And let's not forget he closed up shop after that whole thing, too. Opened it back up in 2013, but still...

And now he's bailing again? Citing disagreements with the market? Sounds like someone can't handle not being right all the time. Maybe he should stick to re-watching his movie and counting his money.

Scion's third-quarter filing showed bearish bets on Nvidia and Palantir. Okay, so he bet against the AI hype. So what? Everyone's got an opinion on AI. Doesn't make him a genius. He spent $9.2 million on options to sell Palantir shares at $50 in 2027. A bold move, sure, but is it going to pay off? Who knows? The future is anybody's guess. These tech bros could figure out cold fusion by then, for all we know.

And what about this Phil Clifton guy he's supposedly naming as his successor? Who the hell is Phil Clifton? Some random name nobody's ever heard of. Is this supposed to reassure investors? "Don't worry, I'm leaving, but I'm putting this guy in charge!" Yeah, that's not suspicious at all. Michael Burry to shut down hedge fund, names Phil Clifton as successor

Scion's Undoing: Hubris?

Burry shuttered his previous firm in '08. History repeating itself, maybe? This time, he’s supposedly liquidating the funds and returning capital by year’s end, but with a "small audit/tax holdback." Translation: "I'm taking my cut before you get yours."

He's deregistering with the SEC, too, which could mean he's closing the fund to outside investors, or just straight-up shutting it down. The March filing said the firm had around $155 million in AUM. That ain't exactly chump change, but it's also not exactly running the world.

Maybe Burry just got tired of the pressure. Or maybe, just maybe, he realized he's not as smart as everyone thinks he is. Could be hubris, could be something else. I don't know, I ain't a psychologist.

I mean, let’s be honest, the guy’s been wrong plenty of times since '08. He predicted a massive market crash in 2022 that never really materialized. He's been screaming about inflation for years, and while it's been a pain in the ass, it hasn't exactly brought down the global economy.

He posted a bunch of stuff on his account about circular financing concerns surrounding Nvidia. Okay, so he read a Bloomberg article. Big deal. I read Bloomberg articles too, offcourse doesn't make me a hedge fund guru.

What's Next? More Predictions?

So, what's next for Michael Burry? Another round of cryptic tweets? Another doomsday prediction? Another movie deal? Honestly, who cares?

He'll probably resurface in a few years with some new outlandish prediction, and the media will eat it up because, hey, he was right once. But let's not forget the countless times he's been wrong.

So, What's the Real Story?

Burry's just another rich guy playing the market. He got lucky once, and now he's milking it for all it's worth. I'm not saying he's a bad guy, necessarily, but this whole "genius investor" persona is way overblown. The guy is a glorified gambler, and I'm not shedding any tears over his latest exit.

Related Articles

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...

USPS Financial Loss Reforms: What's Happening and Why You Should Care

Generated Title: The USPS is Bleeding Money (Again). Color Me Shocked. Okay, so the USPS is hemorrha...

The Surprising Tech of Orvis: Why Their Fly Rods, Jackets, and Dog Beds Endure

When I first saw the headlines about Orvis closing 31 of its stores, I didn't feel a pang of nostalg...

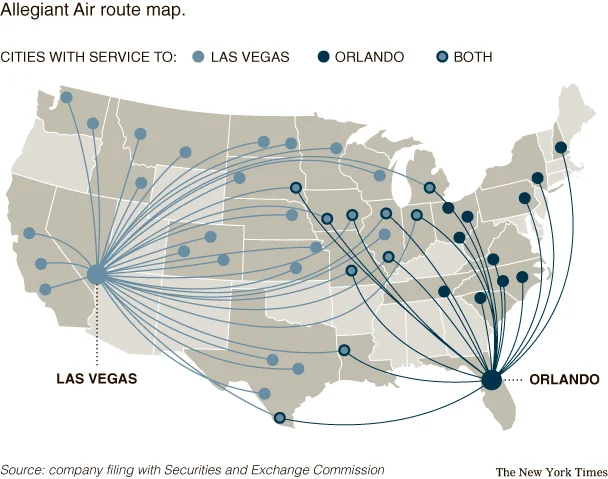

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...

Dow Jones Tumbles: Tech Sell-Off and Rate Cut Uncertainty

Alright, let's get into it. Thursday wasn't pretty if you were watching the tickers. The Dow took a...