Zcash's Winklevoss Backing: Price Surge vs. Crypto Market Reality

Generated Title: Winklevoss Doubles Down: Is Zcash the New Corporate Treasury King?

The Curious Case of Cypherpunk Technologies

Leap Therapeutics, a biotech firm, just pulled a fast one. Or, rather, a smart one, depending on your perspective. They rebranded as Cypherpunk Technologies (CYPH), sunk $50 million into Zcash (ZEC), and got the Winklevoss twins to back the whole thing. It's a bold move, considering the general market jitters around crypto. The company acquired 203,775.27 ZEC tokens at an average price of $245. That's a significant bet on privacy-focused crypto.

The immediate reaction? CYPH stock nearly doubled, jumping almost 100% on Friday. Zcash itself defied the overall crypto market dip, gaining 16% while Bitcoin (BTC) stumbled. Thor Torrens, a former POTUS advisor and Zcash advisory panel member, even took to X (formerly Twitter) to declare that "privacy is not a trend." I'm not sure I'd hang my hat on a single stock jump, but it's certainly a data point.

Here's where things get interesting. Cypherpunk aims to hold at least 5% of Zcash's total supply. With roughly 16.3 million ZEC in circulation, their initial purchase already accounts for about one-fifth of that target. The stated goal is to create long-term shareholder value through active participation in Zcash. But how active can they really be? And what does “active participation” even mean in this context? Are we talking about staking, governance, or something else entirely? Details remain scarce on the specifics of their strategy.

The Privacy Premium: Is It Real?

Zcash's surge is attributed to its "cypherpunk principles." Galaxy Digital research analyst Will Owens argues that Zcash is gaining traction as an alternative to Bitcoin amid growing concerns about on-chain surveillance. Zcash allows users to "shield" transactions with zero-knowledge proofs, unlike Bitcoin's fully transparent ledger. Zcash (ZEC) Surges, Leap Therapeutics (LPTX) Jumps on Winklevoss-Backed Digital Asset Treasury

But let's be real: Bitcoin isn't exactly traceable to your doorstep. There are plenty of ways to obfuscate transactions, even on a public ledger. The real question is whether the perception of privacy is enough to drive value.

The company's pivot focuses on Zcash, the largest privacy-focused crypto, which uses zero-knowledge proofs to verify transactions without revealing wallet addresses or amounts, unlike Bitcoin’s fully transparent ledger. The price data shows ZEC surging nearly tenfold in two months, peaking near $735 on Friday and triggering $51 million in short liquidations, before easing to about $464 early Wednesday, according to CoinGecko data, still 85% below its 2016 high of $3,191.

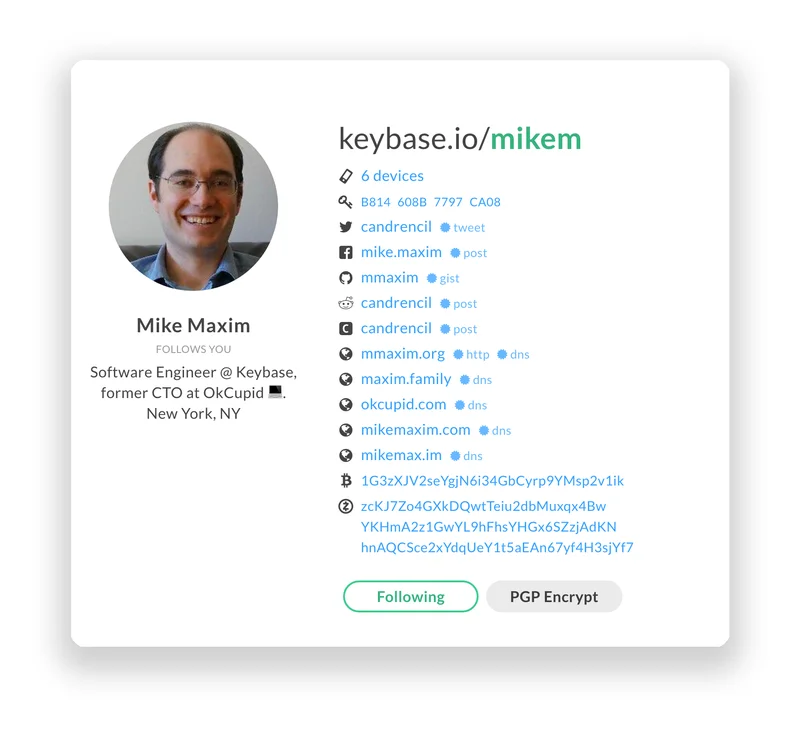

Consider this: Winklevoss Capital led a $58.88 million private placement for Cypherpunk. That's a hefty investment, but it's also a clear signal of confidence (or, at least, a calculated risk). Will McEvoy, a Principal at Winklevoss Capital, is now Cypherpunk’s Chief Investment Officer. That's not just a financial commitment; it's a human one.

Now, here's the part I find genuinely puzzling. Why Zcash? Why not Monero (XMR), which has a longer track record and arguably stronger privacy features? Is it simply because the Winklevoss twins have a vested interest in Zcash, or is there a deeper strategic rationale? There are whispers on Reddit that Zcash is more regulator-friendly, but I haven’t seen any hard data to back that up. (I'd want to see transaction data on the shielded pool before making any claims.)

The Winklevoss Bet: Vision or Vanity?

The Winklevoss twins have a history of making bold bets in the crypto space. Their investment in Cypherpunk could be seen as a visionary move, recognizing the growing demand for privacy in a world of increasing surveillance. Or, it could be a vanity project, a way to boost the value of their existing Zcash holdings.

Oei is the founder and CEO of Treasury, a Netherlands-based Bitcoin treasury company that raised $147 million (€126 million) in September through a private round led by Winklevoss Capital and Nakamoto Holdings. Other crypto treasuries faltered under “short-term, mercenary capital,” McEvoy noted, while Cypherpunk built a “value-aligned” investor base focused on the long-term importance of Zcash and privacy for the “United States and the world.”

It's also worth noting that Gemini, the crypto exchange founded by the Winklevoss twins, recently filed to enter the prediction markets business and reported its first quarterly results as a public company following a September IPO. Gemini reported a $159.5 million net loss in its Q1 earnings report, driven by IPO-related expenses and higher marketing costs. The financial results are a mixed bag.

What's the endgame here? Is Cypherpunk a legitimate attempt to build a Zcash-based treasury, or is it a clever way to pump the price of ZEC? The data is inconclusive, but the potential for conflicts of interest is undeniable.

So, What's the Real Story?

Cypherpunk's Zcash gamble feels like a high-stakes poker game where everyone's cards are face down. There's potential, sure, but also a whiff of financial engineering. I'm not saying it's a scam, but I'm definitely keeping my eye on the data. The next few quarters will reveal whether this is a brilliant strategy or a cautionary tale.

Related Articles

Zcash's Breakthrough: Why It's Surging and What the Community Thinks Is Next

I have to be honest with you. For the past few years, watching the Zcash (ZEC) chart has felt like w...

Zcash Rebrands as Cypherpunk: Shielded Pool Growth vs. Market Sell-Off

Generated Title: Cypherpunk's Zcash Bet: Genius Privacy Play or Winklevoss Ego Trip? Rebranding and...

Zcash's Big Price Pump: What It Is, Why Everyone's Suddenly Talking, and If You Should Care

So, the ghost in the machine is twitching again. Zcash (ZEC), the crypto world’s Schrödinger's cat o...