Zcash Rebrands as Cypherpunk: Shielded Pool Growth vs. Market Sell-Off

Generated Title: Cypherpunk's Zcash Bet: Genius Privacy Play or Winklevoss Ego Trip?

Rebranding and a Bold Pivot

Leap Therapeutics, a company previously focused on cancer therapies, has rebranded as Cypherpunk Technologies, making a hard pivot towards accumulating Zcash (ZEC). They’ve already spent $50 million—or rather, $50 million of proceeds from a private placement—to acquire 203,775.27 ZEC at an average price of $245.37 per coin. The move is backed by Winklevoss Capital, with the Winklevoss twins publicly stating their belief in Zcash as a "privacy hedge" against Bitcoin's transparency. This is more than just a name change; it’s a complete strategic overhaul. The stock jumped nearly 100% on Friday, which indicates that the market likes the new direction.

The stated goal is to acquire 5% of the total Zcash supply (which has a fixed cap, like Bitcoin). At the time of the announcement, their initial purchase accounted for roughly one-fifth of that target. On the surface, it looks like a calculated bet on the increasing importance of privacy in the digital age, but is it really that simple?

Deciphering the Motivation

The official narrative focuses on the growing need for privacy in an increasingly transparent world. Cypherpunk argues that Zcash, with its zero-knowledge proofs, offers a valuable hedge against the surveillance risks inherent in Bitcoin and traditional financial systems. As Will McEvoy, now CIO of Cypherpunk, puts it, they’re building a syndicate of value-aligned investors who believe in the long-term importance of Zcash.

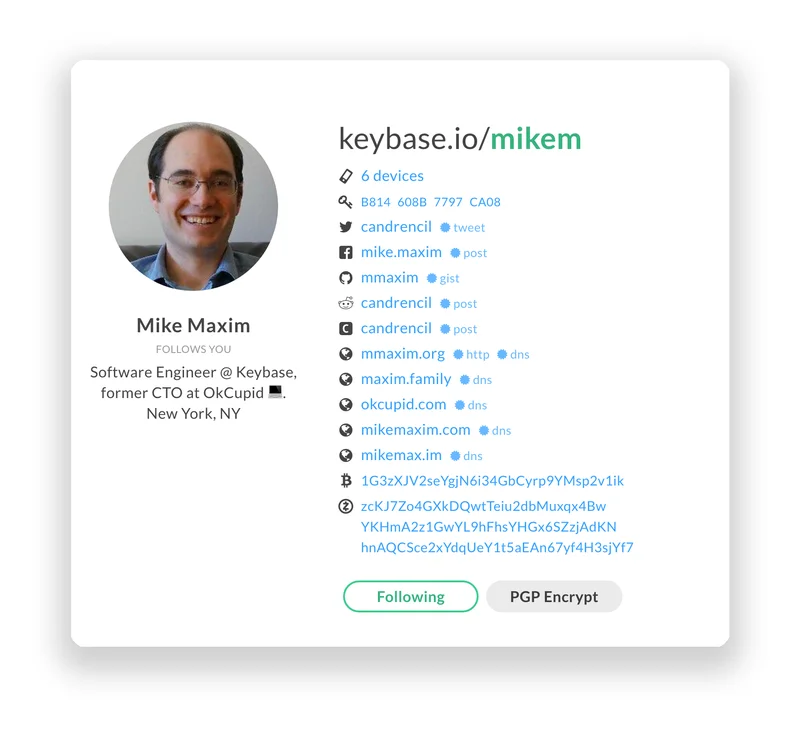

But let's dig a little deeper. The private placement that funded this Zcash acquisition was led almost entirely by Winklevoss Capital. This raises a question: Is this a genuine belief in Zcash's potential, or is it primarily a vehicle for the Winklevoss twins to exert influence in the crypto space? Winklevoss twins bet on Zcash with new treasury firm targeting 5% supply of the privacy coin’s supply

The company also plans to change its ticker symbol to (Nasdaq: CYPH) as part of the rebranding under the Cypherpunk name. The company will begin trading under its new name and ticker symbol CYPH on Thursday, November 13. Until then, investors can continue to buy and sell the company's stock under the current ticker symbol LPTX without interruption.

I've looked at hundreds of these filings, and this particular sequence of events is unusual. It's almost as if they are trying to bury the previous identity of the company.

The timing is also interesting. Zcash has seen a surge in price, and its shielded pool (which obscures transaction details) has climbed to 23% of the total supply, up from 18% just a month prior. This suggests increasing adoption of Zcash's privacy features. However, correlation doesn't equal causation. Is Cypherpunk's investment driving the price, or are they simply riding a wave of existing interest?

The Price of Privacy

Zcash's price has gained over 1,400% in the last 12 months, outpacing Bitcoin's growth during the same period. The company has acquired 203,775 ZEC at an average $245.37 per token, now worth over $573 each. That’s a substantial return on paper.

However, the regulatory landscape for privacy coins remains uncertain. The EU is considering a ban on exchanges listing privacy coins like Zcash, citing concerns about money laundering and terrorism financing. High-profile prosecutions of developers behind privacy-enabling technologies (like Tornado Cash) send a clear message: privacy is not universally welcomed by governments.

This regulatory risk is a significant factor to consider. Cypherpunk's bet on Zcash could be severely hampered if major jurisdictions crack down on privacy coins. The company acknowledges these risks in its forward-looking statements, but the degree of impact is hard to quantify.

The question boils down to this: Can Cypherpunk navigate the regulatory minefield and convince the market that Zcash's privacy features are worth the risk? Or will they end up holding a large bag of coins that are increasingly difficult to trade and use?

Winklevoss's Latest Shiny Object?

This move feels less like a calculated investment and more like a high-profile statement. The Winklevoss twins have a history of making bold bets in the crypto space. Whether this Zcash play will be another Bitcoin-level success remains to be seen, but right now, it smells more like an ego trip than a genius strategy.

Related Articles

Zcash's Breakthrough: Why It's Surging and What the Community Thinks Is Next

I have to be honest with you. For the past few years, watching the Zcash (ZEC) chart has felt like w...

Zcash's Big Price Pump: What It Is, Why Everyone's Suddenly Talking, and If You Should Care

So, the ghost in the machine is twitching again. Zcash (ZEC), the crypto world’s Schrödinger's cat o...

Zcash's Winklevoss Backing: Price Surge vs. Crypto Market Reality

Generated Title: Winklevoss Doubles Down: Is Zcash the New Corporate Treasury King? The Curious Case...