Nvidia Stock Price Rollercoaster: What's Driving the Chaos and the Fanboy Reactions

[Generated Title]: Peter Thiel Ditches Nvidia and Tesla? Good Riddance.

So, Peter Thiel's hedge fund, according to some report from the future (November 17, 2025, to be exact), is dumping Nvidia and trimming its Tesla position. Big deal. Like I'm supposed to clutch my pearls and worry about what a billionaire is doing with his toys? Please. According to Peter Thiel’s hedge fund dumps Nvidia stake, cuts back Tesla position, Thiel's fund is making some moves.

The "Smart Money" Is Usually Dumb

Let's be real, the "smart money" is usually just the money that got in early and now wants to cash out before the rest of us figure out the emperor has no clothes. Thiel's been riding the tech wave for decades. Color me shocked that he's taking some profits.

And frankly, good riddance. The whole narrative around these companies – Nvidia, Tesla, whatever flavor-of-the-month tech stock – is so detached from reality it's nauseating. "AI this," "disruptive technology that." It's all marketing hype designed to pump up the nvidia stock price today and line the pockets of the already obscenely rich.

Don't get me wrong, Nvidia makes good chips. Tesla makes… cars that sometimes catch fire. But are they really worth the insane valuations they command? I mean, bitcoin price is probably more stable at this point. And if Thiel thinks the tesla stock price is unsustainable, maybe – just maybe – he sees something the Kool-Aid drinkers don't.

The LNG Mirage: From Chips to Gas

Speaking of hype, check out this Venture Global (VG) supposedly killing it in the LNG market. Revenues up 260%, earnings per share through the roof… sounds fantastic. Except, I can't help but wonder: how much of that "growth" is tied to geopolitical instability and exploiting resources?

"Streamline high-impact execution," their CEO, Michael Sabel, says. Translation: "We're getting rich off a global energy crisis." Give me a break.

And yeah, natural gas is supposedly "cleaner" than oil. But let's not pretend it's some kind of environmental savior. Fracking ain't exactly a picnic for the planet. So we're trading one set of problems for another, all while companies like Venture Global are laughing all the way to the bank. Is this really progress? Or just a different shade of greenwashing?

I'm looking at amd stock price and intel stock, and honestly, these companies are all caught in the same game. Pump and dump. Hype and hope. The only real winners are the insiders who know when to get out before the music stops.

Cookie Monster

Oh, and before I forget, there's this article about cookies. No, not the delicious kind. The kind that track your every move online. NBCUniversal is apparently very concerned about your "experience" and wants to shower you with personalized ads. How thoughtful. They even have a "Cookie Settings" link in the footer of their websites, as if that makes it all okay.

As if anyone actually reads those privacy policies. It's like they're saying, "We're going to spy on you, but hey, at least we're being transparent about it!" Yeah, thanks. I feel so much better now.

What choice do we even have? Either accept the cookies and get bombarded with targeted ads, or disable them and risk breaking half the internet. It's a lose-lose situation designed to benefit the corporations, not the users.

So, What's the REAL Story?

Thiel's selling off some stock. A gas company is making bank. And we're all being tracked and monitored like lab rats. Shocker. The system is rigged, the game is fixed, and the house always wins.

Related Articles

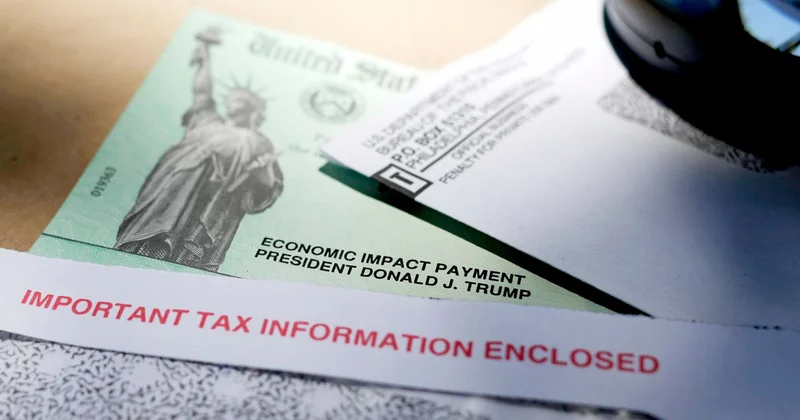

IRS Stimulus Payment November 2025: What We Know and the Fact Check

Alright, friends, let's talk about the future. It's November 2025, and the internet's buzzing again...

Hims Stock Surges 39%: A Data-Driven Look at the Surge

The ticker for Hims & Hers Health (HIMS) has been on a tear. A 39% surge in a single month is the ki...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

Gabe Newell's New Superyacht: Net Worth, Yacht Details, and Reddit's Take

Title: Gabe Newell's $500M Superyacht: Gaming Paradise or Capital Sinkhole? Gabe Newell, the man syn...

Nvidia's "Fundamental Disconnect": What's Really Going On?

Nvidia's Software Sales Struggle: Is This the Beginning of the End for the AI Hype Train? Alright, l...

Cook County Property Tax Bills: Delays and What We Know

Cook County residents are about to get a late Christmas present—or maybe a lump of coal—in the form...