Firo Hard Fork Incoming: Price Swings and What to Expect

FIRO's Privacy Push: Hype or Real Breakthrough?

FIRO, a cryptocurrency focused on privacy, has seen a massive price surge recently, jumping 450% since September. The question, as always, is whether this is sustainable or just another flash in the pan fueled by speculation. The upcoming hard fork on November 19th is adding to the excitement, but let's dig into the numbers to see what's really going on.

The price action is certainly eye-catching. FIRO hit the $3 resistance level, a point it's been struggling with for nearly three years—since June 2022, to be exact. A breakout above this level could send it soaring towards $4.80, but previous attempts have failed. Momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are bullish, but also overbought. This suggests the upward trend could continue, but a correction is definitely on the cards.

Decoding the Sentiment

Social sentiment is a mixed bag. While there's been an increase in chatter around FIRO, it's not driven by the usual suspects (Key Opinion Leaders). This suggests a more organic interest, which is a positive sign. However, the overall level of mentions is still low, especially considering the massive price increase. It's like a small, dedicated group of people are really excited, but the broader market hasn't caught on yet. Will the hard fork be enough to change that, or will it take a sustained price increase to really grab attention? The data doesn't give us a clear answer.

On the daily timeframe, technical analysis suggests a correction is imminent. FIRO appears to have completed a five-wave upward movement since April, and the bearish divergence in the RSI supports this. This could lead to an A-B-C correction (a standard pattern in technical analysis) down to the $1.47 to $1.84 support level. A failed breakout above $3 could trigger this correction, while a decisive close above that level would confirm the bullish trend.

FIRO's recent surge, around 119.2% in two weeks, hit a snag, pulling back to around $2.82 after peaking at $3.11. But the optimism stems from the launch of Spark Assets. Launched in early November 2025, Spark Assets allows developers to mint privacy-first tokens — stablecoins, NFTs, and other instruments — that share one anonymity pool.

This is a fundamental shift. It transforms FIRO from just a privacy coin into a privacy infrastructure layer. Every asset creation or private transaction requires FIRO tokens. Early metrics show rising daily active addresses and higher transaction volumes. Firo’s market cap stands at around $50.69 million with a circulating supply of around 17.9 million. Trading volume recently sat between $2.56 and $2.94.

The privacy coin sector narrative also helps FIRO. It was the first to launch zero-knowledge privacy on mainnet and the first to deploy Dandelion++. Firo’s masternode architecture pairs with miners in a hybrid PoW + LLMQ system to deliver InstantSend and ChainLocks. The combination of privacy, instant finality, and chain security is rare among privacy coins. Regulatory pressure and exchange listings remain unpredictable. Past delistings have dented liquidity.

The community also faces a mandatory software update before the scheduled hard fork on November 19, 2025. Upgrade v0.14.15.0 introduces Spark Name transfers and lowers GPU VRAM mining requirements to include 8GB cards. Technically, FIRO faces clear resistance near $3, a level that has capped rallies since mid-2022. The daily RSI sits firmly in bullish territory, though oversold, and the MACD histogram remains positive. A failed breakout could open a correction toward the $1.47–$1.84 zone. A decisive weekly close above $3 might accelerate a move toward roughly $4.80. Traders should also watch the 38.2% Fibonacci retracement at about $2.60. A dip below this level could mean further decline towards the 50% Fibonacci retracement.

Ultimately, investors should watch how on-chain adoption for Spark Assets evolves. If Spark Assets continue to attract cross-chain activity through partners like Confidential Layer, FIRO may see steady utility-led demand. Conversely, a failed test and weaker liquidity could prompt deeper pullbacks.

Questioning the "Utility" Narrative

But let's pause here. The narrative being pushed is that Spark Assets is driving "real utility." Is it, though? Rising active addresses and higher transaction volumes are good signs, but what kind of transactions are we talking about? Are these just people moving FIRO around to speculate on the price, or are they actually using Spark Assets to create and trade privacy-focused tokens? The data is vague. We need to see more detailed breakdowns of transaction types and user behavior to truly assess the utility of Spark Assets.

I've seen this pattern before (and this is the part of the report that I find genuinely puzzling): A cryptocurrency announces a new feature, the price jumps, and everyone starts talking about "real-world utility." But when you dig into the data, it often turns out that the utility is mostly just speculative trading disguised as something more substantial. Is FIRO different? Maybe. But I'm not convinced yet.

Is Privacy Enough to Sustain the Hype?

Related Articles

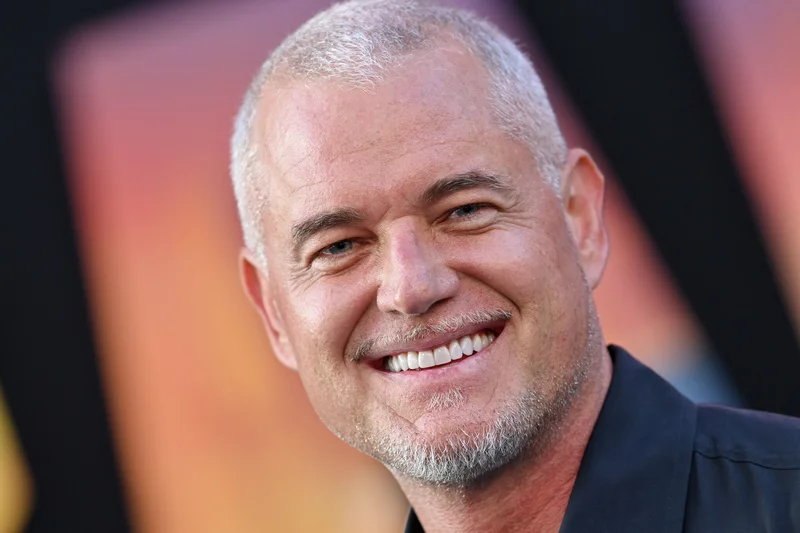

Eric Dane's ALS Diagnosis: What We Know About His Current Health Status

The public persona of an actor is a carefully constructed asset. For years, the primary data points...

James May: His Wife, Net Worth, and Life After Top Gear

The public narrative surrounding the dissolution of a 22-year media partnership is typically framed...

The AtomOne Fork: An Analysis of the Co-Founder Split, the Controversy, and What the Data Shows

A search for the term "AtomOne" presents a clean, almost perfect, case study in technological diverg...

FICO's Latest Scheme Sends Stock Soaring: What It Actually Means and Who Pays the Price

So, FICO is letting mortgage lenders buy its magic numbers directly now. The press release, offcours...

Royal Caribbean Norovirus Outbreak: What the CDC Data Reveals and the Numbers Involved

The latest incident report from Royal Caribbean’s Serenade of the Seas presents a tidy, almost clini...

Monero Nears $400: What's Driving the Move and Reddit's Take

Okay, folks, buckle up, because we're diving deep into something truly fascinating: Monero (XMR) and...